The Last Blue Ocean: A Strategic Market Analysis of Iran’s Tourism & Entertainment Ecosystem

- admin

- ABUDHABI, CLUBBING, CONCERT, DUBAI, EVENT, event industry, EVENT MARKETING, FESTIVAL, FINANCE, GEN Z, GIG, HARDWARE, INVESTMENT, INVESTOR, IRAN, IRAN REVOLUTION, MARKETING, MENA, MIDDLE EAST, NIGHTLIFE, PAHLAVI DYNASTI, PERISAN COMMUNITY, PERSIAN, POTENTIAL, REZA PAHLAVI, SOFTWARE

- 0 Comments

Strategic Market Assessment: The Iranian Leisure, Entertainment, and Tourism Ecosystem – A “Blue Ocean” in a Saturation Crisis

By: Alireza Ariya

1. Executive Strategic Overview: The Asymmetric Opportunity

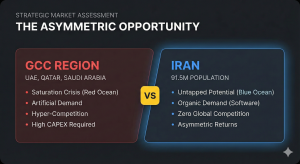

In the contemporary landscape of global emerging markets, the Islamic Republic of Iran represents a singular economic paradox: a nation of 91.5 million people possessing the demographic and cultural profile of a consumption powerhouse, yet structurally isolated from the global economy.

This isolation has created a “Blue Ocean” of untapped potential amidst a region characterized by “Red Ocean” saturation. While neighbors in the Gulf Cooperation Council (GCC)—specifically the United Arab Emirates (UAE), Qatar, and Saudi Arabia—invest hundreds of billions of dollars to manufacture tourism demand through artificial infrastructure and “giga-projects,” Iran possesses the organic “software” of history, culture, and climate necessary for a thriving leisure economy.

The strategic thesis of this report posits that the Iranian market is not merely an opportunity for growth but a venue for “asymmetric returns.” The asset valuations in Iran are currently depressed by the mismanagement of a radical Islamic regime, international sanctions, and political risk. However, the underlying fundamentals—a highly educated youth population (“The Youth Bulge”), a sophisticated cultural heritage, and diverse climatic zones—remain intact. The primary barrier to value realization is a political bottleneck rather than a lack of demand.

Beyond these fundamentals, Iran is characterized by a phenomenon of pent-up demand. After more than four decades of cultural contraction and social restrictions, society has cultivated a form of cultural resistance in its urban sublayers. This suppressed demand functions like a compressed spring: once released, it will drive explosive growth in leisure consumption. Importantly, there is no need for demand generation in Iran; the demand already exists and has been displaced into underground economies and capital flight. The strategic challenge is not to create appetite but to facilitate supply.

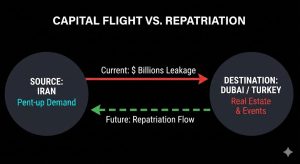

The market is currently defined by a “Two-Speed Economy.” On the surface, the state-imposed “Resistance Economy” dictates austerity and censorship. Beneath this, a dollarized elite and a resilient middle class engage in aggressive leisure consumption, often channeling capital abroad to Dubai and Turkey to access the freedoms denied domestically. This “Capital Flight” is not lost money; it is displaced demand. The core investment opportunity lies in the repatriation of this spending through the development of domestic infrastructure—from world-class arenas in Tehran to boutique heritage hotels in the desert—once political normalization occurs.

2. The Political Economy of Transition: Regime Change as a Market Driver

Any rigorous analysis of the Iranian market must address the political environment. The current radical Islamic regime has structurally dismantled the country’s tourism potential through social restrictions and international isolation. However, current political dynamics suggest a rising probability of regime change, which would serve as the ultimate catalyst for unlocking this multi-billion dollar market.

2.1 The Secular Shift and the Pahlavi Vision

The prospect of a transition to a secular, liberal democracy is becoming the central thesis for long-term strategic planning. The opposition, notably symbolized by Crown Prince Reza Pahlavi, advocates for a governance model based on secularism, the rule of law, and global integration.

Liberalization of Social Norms: The Pahlavi family’s legacy and current political platform emphasize a secular, liberal approach. A transition to such a government would likely result in the immediate removal of “Gender Apartheid” and mandatory Islamic dress codes. This shift would instantly double the addressable market for leisure activities (beaches, pools, sports) and remove the primary psychological barrier preventing Western tourists from visiting Iran.

The “Phoenix Project” (Project Ghognos): To prepare for this transition, the “Phoenix Project” has been established to harness the expertise of Iranian scientists and technocrats. This initiative focuses on stabilizing the economy and rebuilding infrastructure post-regime, signaling to investors that a transition would be managed by expert-led governance rather than chaotic vacuums.

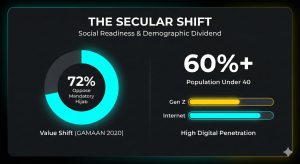

Secularization and Value Shift: Beyond political leadership, surveys by the GAMAAN Institute (2020) reveal that only 32% of Iranians identify as Shia Muslims, while a growing share describe themselves as non-religious, agnostic, or spiritually independent. 68% believe religious rulings should be excluded from legislation, and 72% oppose mandatory hijab. These findings demonstrate that the cultural risk of investing in modern entertainment is far lower than perceived. Unlike Saudi Arabia, where cultural liberalization is engineered top-down, Iran’s transformation has already occurred bottom-up, making the market uniquely primed for rapid adoption of global leisure norms.

2.2 The “Cyrus Accords” and Regional Integration

A key pillar of the opposition’s roadmap is the “Cyrus Accords,” a proposed regional peace treaty modeled after the Abraham Accords. Normalizing relations with Israel and Arab neighbors would dismantle the geopolitical risk premium currently attached to Iranian assets, allowing for the free flow of Foreign Direct Investment (FDI) and integrating Iran into the global tourism value chain.

Strategic Conclusion: The collapse of the current theocratic system and the rise of a secular government would trigger an “Event Industry Revolution,” transforming Iran from a pariah state into the region’s most lucrative emerging market.

3. Historical Heritage as Market “Software”: The Pre-1979 Benchmark

To understand the latent potential of the Iranian market, investors must look to the country’s historical baseline. Unlike Saudi Arabia, which is building an entertainment industry from a tabula rasa via Vision 2030, Iran possesses a deep-seated institutional memory of hosting global culture. This “cultural DNA” reduces the friction of market re-entry. Importantly, Iran before 1979 was not a passive consumer of imported culture but an active cultural hub, positioning itself at the forefront of global artistic exchange.

3.1 The Shiraz Arts Festival (1967–1977): A Template for Global Integration

The Shiraz Arts Festival (Jashn-e Honar) remains the definitive case study for Iran’s capacity to host high-caliber international events. Established under the patronage of Queen Farah Pahlavi, the festival was not merely a regional gathering but the vanguard of the global avant-garde, described by critics as “the most important performing arts event in the world” at its peak.

Intercultural Dialogue: The festival pioneered a “Third World rewriting” of cultural production. It did not simply import Western art; it created a dialogue between East and West. It hosted Western luminaries like Peter Brook (who created Orghast specifically for the festival), Merce Cunningham, Iannis Xenakis, and Karlheinz Stockhausen alongside masters of traditional Persian music and Asian arts.

Cultural Diplomacy: Beyond its artistic significance, the festival functioned as a platform of cultural diplomacy, positioning Iran as a safe and progressive destination for modern art. This role as a mediator between East and West distinguished Iran from its regional peers and demonstrated its ability to attract the global cultural elite.

Site-Specific Infrastructure: Performances were staged in the ancient ruins of Persepolis (e.g., Xenakis’s Polytope de Persepolis) and the open-air spaces of Shiraz. This demonstrated a sophisticated use of heritage sites for modern tourism—a model that Saudi Arabia is now attempting to replicate in AlUla, fifty years later.

Legacy for Future Tourism: The festival proved that Iran could attract the global cultural elite. For investors, the revival of such a festival would not require “brand building” from scratch but rather the “brand restoration” of a dormant intellectual property that still holds immense prestige in global artistic circles.

3.2 The Aryamehr Stadium Legacy: Mega-Event Capability

The potential for “Mega-Events” is substantiated by historical precedent. In 1975, Frank Sinatra performed at the Aryamehr Stadium (now Azadi Stadium) to a sold-out crowd of thousands. This event demonstrated the existence of:

- Physical Capacity: The ability to manage logistics, sound, and security for tens of thousands of attendees.

- Market Affordability: A middle class with sufficient disposable income to purchase tickets for top-tier Western acts.

- Global Connectivity: The ability to route major world tours through Tehran.

The “gap” today is not in the appetite for such events—which is higher than ever due to the youth bulge—but in the regulatory permission to hold them. The instant a political opening occurs, the “muscle memory” of the market is expected to facilitate a rapid return to large-scale touring. Moreover, the physical infrastructure built in the 1970s, though now outdated, still forms the cultural skeleton of Tehran’s event landscape, awaiting modernization rather than reinvention.

3.3 National Festivals as Organic Branding

Iran possesses one of the richest calendars of ancient festivals in the world, which can serve as organic branding assets for the leisure industry. Nowruz, the Persian New Year, already mobilizes millions domestically and could evolve into a two-week mega festival of music, food, and street art attracting international tourists. Other revived festivals such as Mehregan (autumn harvest) and Sepandarmazgan (day of love and earth) are increasingly celebrated by younger generations, offering unique opportunities for event marketing. Unlike artificial festivals in neighboring states that require massive budgets to build identity, these events mobilize crowds spontaneously. For example, Cyrus Day at Pasargadae annually attracts thousands despite state crackdowns, and in a normalized environment could rival global anchor events like St. Patrick’s Day.

3.4 Global Festivals Penetration

Despite official resistance, Western global festivals have penetrated Iranian urban life. Valentine’s Day and Halloween are celebrated enthusiastically in major cities, with cafés and shops decorating spaces despite police threats. This generates significant turnover in accessories, costumes, and confectionery. Even Christmas decorations are visible in Tehran’s malls. Some scholars trace Halloween’s roots to ancient Aryan rituals, which facilitates its acceptance among nationalist circles. In a liberalized market, integrating these global events into the official calendar would fill seasonal gaps between national festivals, ensuring year-round revenue streams. For instance, Black Friday sales are already popular online in Iran and could be combined with music and entertainment festivals, replicating Dubai Shopping Festival at a larger scale.

3.5 Demographic Profile and Digital Penetration

Iran’s demographic profile underscores the scale of opportunity. With a population of 91.5 million (2024), over 60% are aged 15–64, and the majority are under 40—the prime consumers of lifestyle, technology, and entertainment. Urbanization stands at 76%, concentrating demand in megacities like Tehran, Mashhad, and Isfahan. Internet penetration is estimated at 80–85%, with 48 million Instagram users, making Iran one of the largest social media markets in the Middle East. This youth bulge, digitally connected and globally aware, guarantees a ready-made audience for modern leisure industries. The high rate of urban concentration also reduces logistical costs for event organizers, further strengthening the investment case.

3.6 Secularization and Value Shift

Beyond demographics, the cultural value shift is critical. Surveys by the GAMAAN Institute (2020) reveal that only 32% of Iranians identify as Shia Muslims, while a growing share describe themselves as non-religious, agnostic, or spiritually independent. 68% believe religious rulings should be excluded from legislation, and 72% oppose mandatory hijab. These findings demonstrate that the cultural risk of investing in modern entertainment (clubs, concerts, fashion events) is far lower than perceived. Unlike Saudi Arabia, where cultural liberalization is engineered top-down, Iran’s transformation has already occurred bottom-up, making the market uniquely primed for rapid adoption of global leisure norms.

4. Structural Gap Analysis I: The “Hardware” Crisis and Venue Economics

While the “software” of demand exists, the “hardware” of infrastructure has suffered from forty years of underinvestment and isolation. This creates a specific, quantifiable opportunity for construction and real estate development.

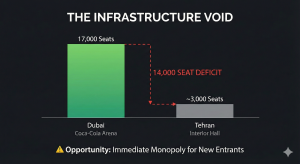

4.1 The Arena Void: Tehran vs. Dubai

A stark comparison of entertainment infrastructure reveals the magnitude of the opportunity in Tehran. The capital city lacks a modern, multi-purpose indoor arena, forcing high-value events to migrate to neighboring hubs.

Table 1: Comparative Venue Analysis

| Feature | Dubai (Coca-Cola Arena) | Tehran (Ministry of Interior Hall) | The Strategic Gap |

|---|---|---|---|

| Capacity | 17,000 (Scalable) | ~3,000 | 14,000 Seat Deficit |

| Technology | Automated retractable seating, climate controlled for year-round use | 1970s acoustic design, fixed seating, limited AV capabilities | Modernization Required |

| Functionality | Multi-purpose (Sports, Concerts, E-sports, Gala Dinners) | Single-purpose (Speeches, Limited Concerts) | Flexibility Deficit |

| Utilization | Year-round (365 days) | Sporadic | Revenue Efficiency |

Strategic Implication: Tehran, a metropolis of 14 million people, cannot host a major international tour due to this deficit. The Coca-Cola Arena in Dubai serves as the regional benchmark, capturing high-end Iranian demand (capital flight).

The Investment Case: Developing a 15,000–20,000 seat indoor arena in Tehran would immediately monopolize the domestic event market. Unlike Dubai, which relies on transient tourists, a Tehran arena would have a captured domestic audience, guaranteeing base occupancy rates independent of seasonal tourism.

Festival Cities Concept: In addition to arenas, Iran could pursue the development of Festival Cities—dedicated entertainment complexes near Imam Khomeini International Airport or within free trade zones. These hubs would integrate venues, hotels, shopping, and leisure facilities into a single ecosystem, easing traffic congestion and creating a self-sustaining entertainment economy. Saudi Arabia is currently investing billions into its Qiddiya project to achieve similar goals, but Iran could replicate this model at significantly lower cost due to existing infrastructure and cheaper labor, achieving faster returns on investment.

4.2 The “Brownfield” Opportunity: Caravanserai Revitalization

Beyond new builds, there is a massive opportunity in “Brownfield” investment—specifically, the adaptive reuse of historical assets. The Iranian “Revitalization and Utilization Fund for Historical Places” has identified hundreds of Safavid-era caravanserais for conversion into boutique hotels.

The Concept: These structures, originally built as roadside inns on the Silk Road, feature central courtyards and fortified walls. They represent unique architectural intellectual property that cannot be replicated by new construction.

The Model: The Fund cedes these properties to private investors for long-term leases (e.g., 20 years) in exchange for restoration and operation. Successful examples include the Sa’d al-Saltaneh Caravanserai in Qazvin. This model offers high returns by converting “dead capital” into luxury hospitality assets, similar to the Paradores of Spain. For investors, this represents a rare opportunity to monetize heritage properties while simultaneously preserving cultural identity.

5. Structural Gap Analysis II: Geographic and Climatic Arbitrage

Geography acts as Iran’s most durable competitive advantage. The country’s topography allows for “Climate Arbitrage” against the GCC states, offering a diversity of experiences that neighbors cannot match without exorbitant energy costs. Iran is, in effect, a true four-season country: in January, skiers enjoy alpine conditions at Dizin and Tochal while, on the same day, travelers can relax on the warm beaches of Kish or Qeshm. This natural diversity is a unique selling point that no artificial project in the Gulf can replicate.

5.1 The Caspian Potential: The “Summer Refuge”

While the southern littoral states of the Persian Gulf (UAE, Qatar, Saudi Arabia) experience extreme heat from May to September, with temperatures exceeding 45°C, Northern Iran offers a complete climatic inversion.

The Hyrcanian Forests: The Caspian coast is backed by the Hyrcanian forests, a UNESCO World Heritage site dating back 25 to 50 million years. This lush, green “rainforest” environment creates a temperate, humid climate that acts as a natural refuge from the arid Gulf.

The Gap: Currently, this region serves almost exclusively domestic tourists due to poor international marketing. Upgrading hospitality standards in cities like Ramsar and Chalus could capture a significant portion of the GCC summer outbound market, which currently travels to Europe or Turkey to escape the heat.

Winter Sports Infrastructure: Iran’s ski resorts add another dimension to this arbitrage. Dizin, one of the highest ski resorts in the world at 3,600 meters, is certified by the International Ski Federation (FIS) and offers powder snow conditions attractive to professionals. Tochal, accessible directly by cable car from northern Tehran to 3,740 meters, is the closest ski resort to a capital city anywhere in the world, enabling unique “urban-mountain tourism.”

5.2 Island Strategy: Qeshm vs. Kish

While Kish Island is well-known as a luxury free zone modeled after Dubai, Qeshm Island represents a distinct, underutilized asset class centered on eco-tourism.

UNESCO Geopark: Qeshm is home to the first UNESCO Global Geopark in the Middle East, featuring the Valley of Stars and the Chahkooh Canyon.

Hara Forests: The island hosts the largest mangrove forests (Hara forests) in the Persian Gulf, a critical biosphere for migratory birds.

The Gap: Unlike Kish’s “mall culture,” Qeshm lacks high-end eco-lodges and experiential tourism operators. The potential lies in developing sustainable luxury resorts that cater to the global adventure travel segment—a market Saudi Arabia is spending billions to create artificially in its Red Sea Project, but which exists naturally here. Kish itself already attracts around one million tourists annually, but its true potential will only be realized once beach clubs and nightlife are liberalized, positioning it as the “Ibiza of the Middle East.”

5.3 Comparative Climate Advantage

A comparative analysis highlights Iran’s unmatched diversity:

- Winter Sports: Natural alpine skiing (Dizin, Tochal) vs. Dubai’s indoor Ski Dome and Saudi Arabia’s unfinished Trojena project.

- Summer Climate: Temperate Caspian and mountain regions vs. GCC states exceeding 40°C.

- Winter Climate: Mild southern coasts (Kish, Qeshm, Chabahar) vs. Gulf states at 20–25°C.

- Environmental Diversity: Hyrcanian forests, Lut desert, mangroves, alpine ranges vs. predominantly desert and coastal ecosystems in GCC.

This diversity allows simultaneous skiing and beach tourism in one day—a unique selling point for global adventure travelers.

5.4 Consumer Behavior and Loyalty

Iranian consumers demonstrate extraordinary willingness to pay for entertainment, even under economic pressure. Concert tourism to Turkey and Dubai illustrates this: Iranians spend $200–$1,000 per ticket/package to attend performances by icons like Ebi, Googoosh, or Shadmehr. In Istanbul, Iranians comprised 35% of the audience at global DJ Anyma’s concert. This loyalty shows that Iranian musical taste is fully aligned with global trends. Similarly, Iranians are among the top buyers of real estate in Turkey and Dubai, motivated not only by investment but by access to lifestyle freedoms. If similar conditions were available domestically (e.g., in Kish or Caspian villas), billions of dollars in capital leakage could be repatriated. Crucially, entertainment is treated as a priority household expense, often taking precedence over other categories of spending, underscoring the depth of demand.

6. The Organic Marketing Engine: Leveraging “Cyrus Day” and Festivals

A unique feature of the Iranian market is the existence of “organic” marketing events—dates and festivals that generate massive, spontaneous public mobilization without state support.

6.1 Cyrus Day (October 29): The Unmonetized Super-Event

On October 29, a date officially unrecognized by the Islamic Republic, thousands of Iranians gather at Pasargadae to honor Cyrus the Great, the founder of the Achaemenid Empire and author of the first charter of human rights.

-

Organic Mobilization: Despite road closures, fencing, and security crackdowns by the regime to prevent gatherings, the event draws massive crowds, driven by nationalism and a desire to connect with pre-Islamic identity.14

-

Tourism Potential: In a normalized environment, “Cyrus Day” has the potential to become Iran’s equivalent of St. Patrick’s Day—a global anchor event for cultural tourism. The infrastructure gap is immense: Pasargadae currently lacks the visitor centers and accommodation to handle the millions who would attend if permitted.

-

Political Significance: The event serves as a barometer for secular nationalism. Converting this from a security threat to a tourism asset would generate significant revenue for Fars province.16

6.2 Legal Framework and Investment Incentives (FIPPA)

Iran’s Foreign Investment Promotion and Protection Act (FIPPA) provides a relatively strong legal framework for investors. It guarantees against expropriation, allows repatriation of capital and profits in foreign currency, and covers non-commercial risks. Free trade zones (Kish, Qeshm, Chabahar) offer 20-year tax exemptions, visa-free entry for foreigners, and 100% foreign ownership. These zones can serve as sandbox environments for testing large-scale entertainment projects before nationwide rollout.

7. Capital Flight Analysis: Benchmarking the “Lost” Revenue

The dysfunction of the domestic market has led to massive capital flight. Analyzing where Iranians spend their money outside Iran provides the most accurate roadmap for what they would consume inside Iran if permitted.

7.1 The Dubai Benchmark: Real Estate and Lifestyle Arbitrage

Iranians are consistently among the top foreign investors in Dubai real estate.

Market Volume: In the first half of 2025 alone, Dubai’s real estate market recorded transactions worth approximately $117 billion (AED 431 billion), a historic high.

Iranian Share: Iranians are a top-tier investor group, purchasing properties to secure Golden Visas and residency. This “Capital Leakage” is driven not only by financial motives but by a desire for lifestyle freedom and access to leisure opportunities denied by the current regime. Estimates suggest that billions of dollars in Iranian capital flow annually into Turkey and Dubai, underscoring the scale of displaced demand.

Repatriation Potential: A liberalization of social laws in Iran would undercut the value proposition of Dubai for the Iranian middle class. The “risk premium” paid to move capital abroad would likely be redirected to domestic assets—villas along the Caspian coast, apartments in Tehran, or properties in free zones such as Kish and Qeshm—if the lifestyle gap narrowed.

7.2 Brand Sponsorship and Marketing Potential

Post-sanctions, multinational brands will compete aggressively for market share in Iran’s 90-million consumer base. Physical events—concerts, festivals, sports—will become the most effective mass-marketing channels, offering direct access to the youth bulge. Automotive giants (Peugeot, Renault), tech brands (Samsung, Xiaomi, Apple), and FMCG companies (Coca-Cola, Nestlé) are expected to allocate major budgets to sponsorship.

8. Strategic Conclusions and Future Outlook

The Iranian market is not a speculative “frontier” in the traditional sense; it is a suppressed mature market. The demand is established, the culture is deeply rooted, and the demographics are ideal. The constraints are entirely artificial (political and regulatory). For global capital, this represents an asymmetric investment opportunity: while short-term political risks exist, the long-term rewards are disproportionately high due to the scale of pent-up demand and the uniqueness of Iran’s cultural and geographic assets.

8.1 Critical Success Factors for Investors

-

Early Positioning: Smart capital should not wait for full normalization. Strategic moves—such as land banking in coastal zones (Caspian, Qeshm) and securing rights to “brownfield” assets (caravanserais, historic hotels)—must begin now to capitalize on depressed valuations.

-

Monitoring Political Signals: The rise of secular mobilization and initiatives like the “Phoenix Project” are leading indicators. A regime change would not just open the market; it would revolutionize the global event industry by bringing 90 million sophisticated consumers back online.

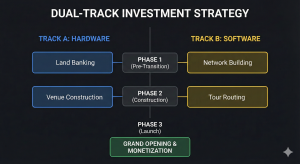

8.2 The Investment Roadmap: A Dual-Track Strategy

To fully unlock the potential of the Iranian market, the investment strategy must be viewed through two distinct but synergistic lenses: the “Hardware” (Infrastructure) and the “Software” (Content & Operations).

A. The “Hardware” Opportunity: Real Estate & Mega-Project Developers

-

The Proposition: For large-scale developers and sovereign wealth funds, Iran presents a “Blue Ocean” for infrastructure. Unlike the GCC, where developers compete in a saturated market of luxury malls and arenas, Tehran faces a near-zero supply of modern venues.

-

The Opportunity: There is an immediate need to construct high-capacity, multi-purpose arenas (15,000–20,000 seats) and “Festival Cities” integrating hotels, retail, and entertainment.

-

Why Act Now: Developers who secure prime locations and begin feasibility studies today will hold a monopoly on the country’s event infrastructure post-transition, guaranteeing high occupancy rates from day one.

B. The “Software” Opportunity: Global Entertainment Giants (e.g., Live Nation, AEG)

-

The Proposition: For global promoters and event management firms, Iran is the missing link in the Eurasian touring circuit. It offers a bridge between the European and East Asian legs of global tours, with a domestic audience larger than Germany’s.

-

The Opportunity: Companies like Live Nation have the opportunity to plan long-term market entry now. This involves identifying local partners, mapping touring logistics, and preparing to manage the venues built by the “Hardware” investors.

-

Why Act Now: Establishing early relationships and “soft power” presence ensures that when the market opens, these giants will have exclusive access to route the world’s biggest artists through Tehran, effectively capturing the region’s largest untapped box office.

C. The Synergy: The Consortium Model The highest value will be realized through Joint Ventures where real estate developers build the “Hardware” specifically tailored to the technical requirements of global entertainment operators (the “Software”). This symbiosis de-risks the capital investment for builders and ensures immediate operational readiness for promoters.

8.3 Final Outlook

Iran stands as the last major closed economy in the world. The “Gap Analysis” reveals that the bridge between the current state of isolation and a future status as a regional tourism superpower is paved with specific projects: building world-class arenas like the Coca-Cola Arena, reviving the Shiraz Arts Festival, and capitalizing on the secular shift.

Strategic Recommendation: The “Sleeping Giant” is already awake; it is merely waiting for the chains of the current regime to be broken. Smart investors—both builders of venues and curators of culture—should not wait for “Day Zero.” By planning the infrastructure and content pipelines today, they will secure outsized returns and market dominance ahead of the inevitable surge of global capital.

References:

- Iran ranks 5th with most STEM graduates – Mehr News Agency, accessed January 6, 2026, https://en.mehrnews.com/news/128088/Iran-ranks-5th-with-most-STEM-graduates

- Iranians’ Attitudes Toward Religion: A 2020 Survey Report – Gamaan, accessed January 6, 2026, https://gamaan.org/2020/08/25/iranians-attitudes-toward-religion-a-2020-survey-report/

- Persian Gulf – Wikipedia, accessed January 6, 2026, https://en.wikipedia.org/wiki/Persian_Gulf

- KISH FREE TRADE ZONE – Encyclopaedia Iranica, accessed January 6, 2026, https://www.iranicaonline.org/articles/kish-free-trade-zone/

- (PDF) GEOTOURISM ATTRACTIONS OF HORMUZ ISLAND, IRAN – ResearchGate, accessed January 6, 2026, https://www.researchgate.net/publication/340310650_GEOTOURISM_ATTRACTIONS_OF_HORMUZ_ISLAND_IRAN

- Dizin Ski Resort – Persian Touring, accessed January 6, 2026, https://persiantouring.com/things-to-do/dizin-ski-resort/

- Turkey Tourism Statistics – How Many Tourists Visit? (2024) – Road Genius, accessed January 6, 2026, https://roadgenius.com/statistics/tourism/turkey/

- Inside Tehran’s nightlife: a hidden world of dance, drinks and defiance | Iran International, accessed January 6, 2026, https://www.iranintl.com/en/202503155272

- In the Name of God Country Report of the Islamic Republic of Iran on FDI Trends, incentives, advantages, regulations and perform – COMCEC, accessed January 6, 2026, https://www.comcec.org/wp-content/uploads/2021/07/29IS-CR2-IRAN-ENG.pdf

- Investing in Qeshm Free Zone: A Strategic Opportunity for Foreign Investors, accessed January 6, 2026, https://qeshmfz.com/en/investment-en/investment_process_en/3554/

- Teaching spoken English in Iran’s private language schools: issues and options – Emerald Publishing, accessed January 6, 2026, https://www.emerald.com/etpc/article/14/2/210/84919/Teaching-spoken-English-in-Iran-s-private-language

- Persian Gulf islands – Tehran Times, accessed January 6, 2026, https://www.tehrantimes.com/news/517150/Persian-Gulf-islands

#BlueOceanStrategy #EmergingMarkets #InvestmentOpportunity #VentureCapital #PrivateEquity #TourismInvestment #RealEstateDevelopment #HospitalityIndustry #EventIndustry #EntertainmentEconomy #IranBusiness #MiddleEastBusiness #MarketAnalysis #SmartMoney #Tehran #LiveEvents #Infrastructure #HotelInvestment #FutureOfIran #GlobalInvesting #Construction #LandBanking #MusicIndustry #CapitalFlight #KishIsland #ResortDevelopment #BusinessStrategy #LuxuryTravel #AriyaProduction #InvestInIran